One Low Monthly Payment

All of your unsecured debt paid, with a single, low monthly payment. We love helping people save money.

No Interest or Up-Front Fees

With Debt Resolution, you don’t pay until the job is done, and the fees are already factored into your monthly payment.

Lower Balances, Money Saved

With lower negotiated balances and no interest or up-front fees, you’re saving money monthly, and long-term.

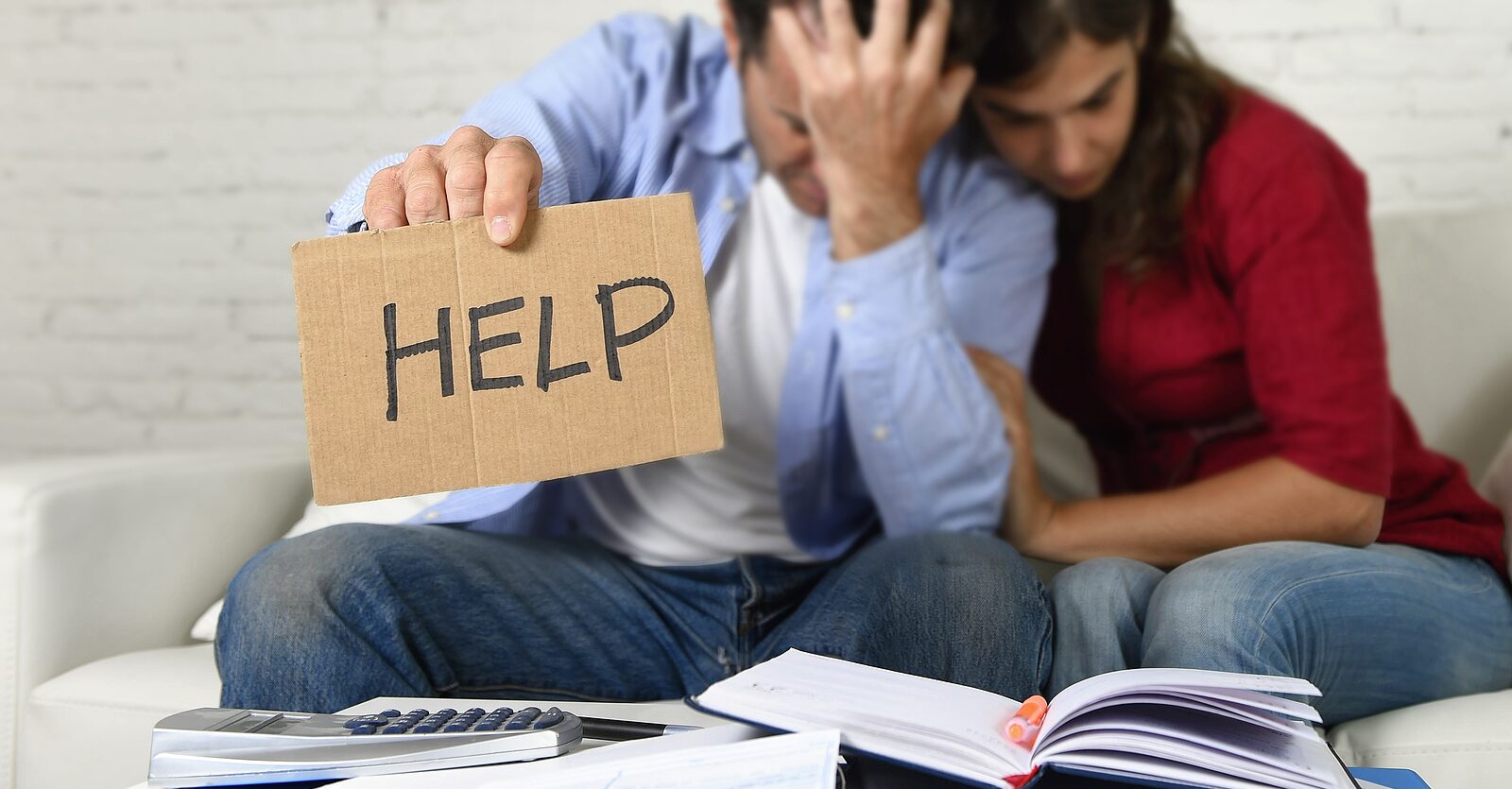

DEBT ENDS HERE

This is where DEBT ENDS and LIFE BEGINS.

Financial independence is our business and we’re passionate about helping people make a fresh start. Our certified consultants are standing by to review your personal situation, and find the best option.

We handle your debt, so you can focus on you.

The first step is a free consultation so we can learn about your personal debt situation. Our certified debt consultants will review your information to determine the best option for you.

Next, our experts will create a customized plan to negotiate and settle your debts quickly, and for less than what’s owed. What does this mean for you? Reduced or eliminated interest rates, lower negotiated balances, and a fast-track to eliminating your unsecured debt.

Debt Relief Doesn’t Have to Be Complicated. We Make it Easy.

We never charge upfront fees. We also don’t make any money unless we settle your debt. This means if you qualify for our program, it’s in our best interest to work hard to reduce your debts quickly.

Our proven debt resolution program keeps your monthly payment low, while we work to lower your balances. When you fall behind, or are stuck making minimum payments, most of your money is going straight to interest (profit for the creditor). This is the trap they set to keep you in debt.

So how do you escape this trap? Resolve your debt for less than you owe, we’ll show you how.

How Exactly Does Debt Resolution Work?

We make thing simple around here, you have enough stress dealing with your debt. Our process is simple, straightforward, and transparent.

Our certified debt consultants review your personal financial situation – We review your debts, finances, and hardships to come up with a single payment solution that works for you.

Prepare To Settle Your Debts – Each month, you’ll set aside a small amount of money to settle your balances. Once you’ve completed your program, you’ll have settled all your debt for less than you owed.

Celebrate your new financial freedom! – Small celebrations as each of your debts are settled, one big celebration when your debt is gone for good. Don’t be afraid to do a little dance.

FINANCIAL EDUCATION

Recent Articles

Finding relief from debt is the first step, staying out of debt is the second. Our Financial Education Blog is designed to help people make better financial decisions, improve their financial literacy, or simply learn about the state of finance.